Mini Exchange secures over $1M in seed funding

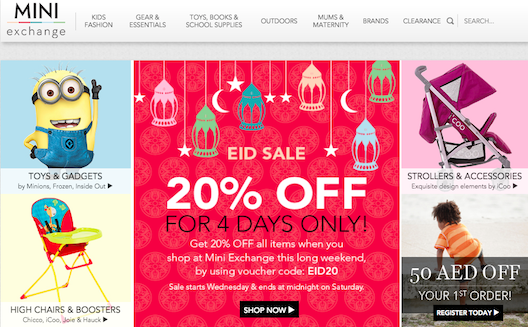

Screenshot of MiniExchange for Eid sale.

Mini Exchange,

an outlet for childrens retailers’ and an online marketplace for

parents to buy everything related to mums and kids needs, announced

today closing its seed fundraising round of over $1 million.

Founder Sarah Appleton, a British expat in Dubai who quit her

job at Deloitte and launched Mini Exchange early last year, told

Wamda during a call that she used convertible notes for her seed

round because the process was relatively quick.

Appleton said it took just three to four months

to close the round, which “puts us in a good position for our next

round”.

The investment came from angels in Europe and

the Middle East, and a small VC in Europe.

Appleton declined to share specific names, but

she did say that the the angel investors include the CFO of one of

the largest media companies in the region, a board member at a

large educational group, a former board member at GAP who is now a

professor at the London Business School, and someone from the

banking sector.

“We’ve created an informal board of advisors and

we meet regularly,” Appleton said. “This was of great support for

me.”

Her angel investors are experts in different

sectors (social, ecommerce, media, retail, legal, financial), and

her decision to involve Europeans was deliberate as “ecommerce is

more developed there than in the region”.

What changed and where is money

going?

Appleton has made some drastic changes in the

way Mini Exchange does business over the past year.

The platform initially encouraged parents to buy

and sell products, new or like-new. But to keep customers from

thinking that all products on Mini Exchange are second hand,

Appleton canceled the selling option.

Speed and scalability were additional

motivators.

“There is definitely a space for a second hand

products business in the region,” Appleton noted. “The service was

actually doing very well. But for us to scale quickly, it made more

sense to focus on one side of the business only.”

Drop Ship

She also reconfigured logistics to remove

barriers to scale.

When Mini Exchange first launched, the platform

stocked goods in warehouses before delivering orders to customers.

Appleton has since eliminated warehouses, and all goods today go

directly from seller to buyers.

To make this system work, the team integrated

Mini Exchange with retailers’ warehouses. When an order is

received, Fetchr picks up the product from the seller’s warehouse

and delivers it to the buyers.

“I want to keep the site as a tech focused platform,

ideally with no products ever touching us physically,”

Appleton said. “I think this makes for a nice business model that

is appealing to investors.”

Nevertheless, Appleton is using the investment

to expand her team and digital marketing. With 300 brands on the

site currently, the company is adding an average of two to three

new regional brands per day.

Additionally, Mini Exchange just started getting

international brands on board, which will give buyers from the

region the opportunity to buy products that were not available in

the region.

“Through its deal with UPS, Fetchr will also be

working on the global distribution,” she said.

Appleton said she is aware of the competition in

this sector, and is working to up her game as fast as

possible.

“I already see us as a tech only platform, a

real marketplace.”

Leave a Reply